Our Presence in the Market is Impressive—Our Ability to Source Quality Communities for our Investors, Incomparable!

Our acquisition pipeline exceeds $500 million in qualified new offerings monthly across our target markets.

We understand how to identify and underwrite qualified opportunities.

Because our team is comprised of national influencers, we are able to win competitive situations more often than not.

Once acquired, we have the know how and firepower to execute—success comes a step at a time.

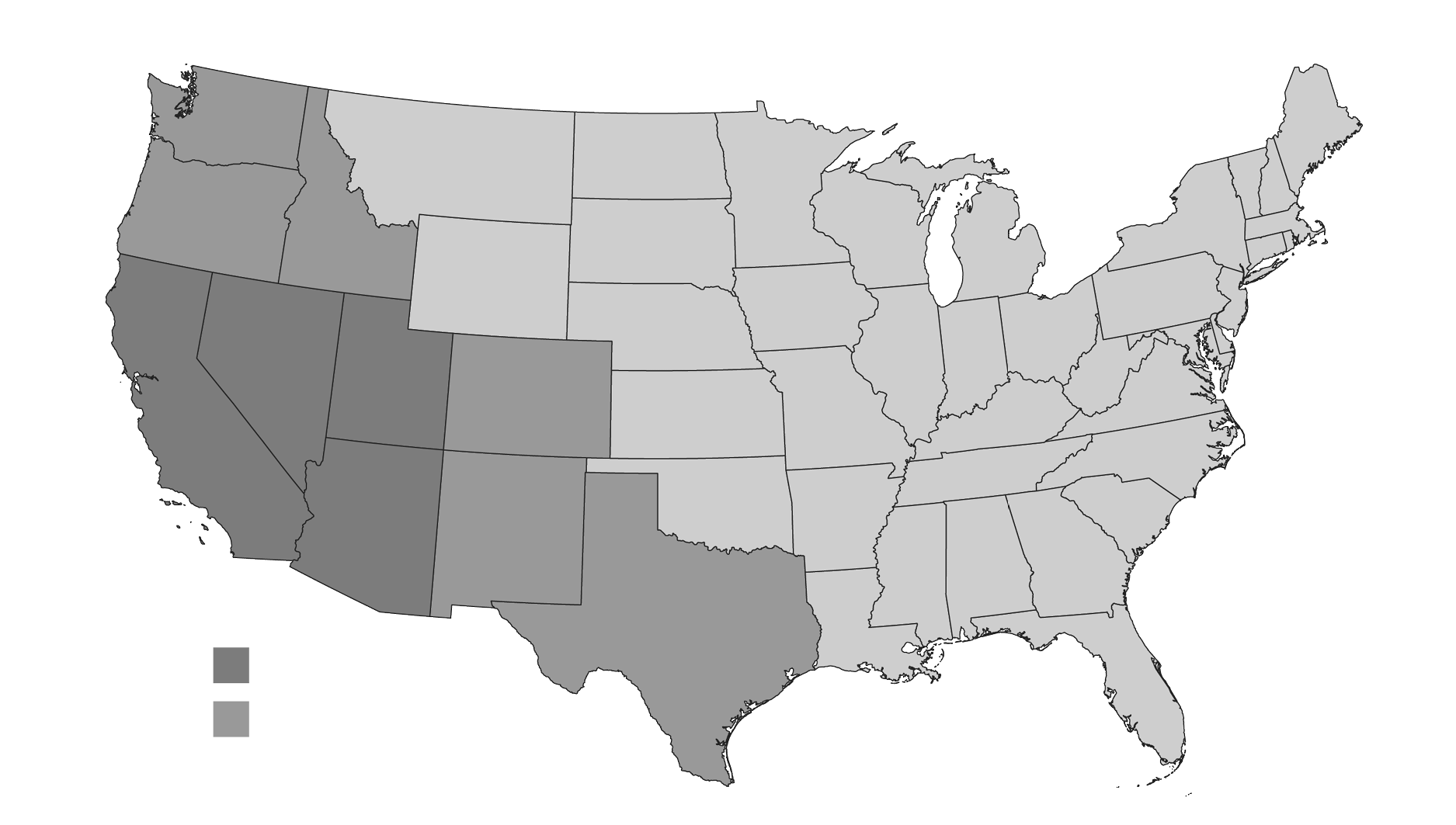

Our Markets

RH Capital invests in four primary markets and a number of secondary markets in the western U.S. We review and analyze more that $500 Million in potential market offerings monthly. With Boots on the ground and significant channels in place to originate, the firm has immediate access to market intelligence and significant acquisition opportunities. The firm is experienced in adding value through problem solving, structured finance, integrated construction, and property management.

RH Capital's Acquisition Targets, Ranges and Markets

| PRIMARY MARKETS | PURCHASE PRICE | STRATEGY THEME |

|---|---|---|

|

PACIFIC REGION: NorCal, including San Francisco Bay Area, Oakland, East Bay, San Jose; So. CA, including Los Angeles, Orange County, Inland Empire, San Diego. |

$20 - $40M | Value Add, Core Plus, Core |

|

INTERMOUNTAIN REGION: NV, Las Vegas, Reno, UT, Salt Lake City. |

$15 - $35M | Value Add, Core Plus, Core |

|

SOUTHWEST REGION: AZ, Phoenix, Tempe. |

$15 - $35M | Value Add, Core Plus, Core |

For Offerings, Contact:

Alex Pascale, Director of Acquisitions, | 858 350 1807 | Apascale@rhcapco.com