The Historical Based Rationale

Why HNW Investors Should Consider Multifamily Real Estate Investment

Real Estate is being viewed increasingly as an essential portfolio component, not as an alternative. Nearly 80% of wealthy investors own real estate—90% of the Forbes 400’s wealthiest individuals made or retain their wealth in real estate.

From 1995 - 2020

70%

of the Nation’s Apartment Stock is owned by Private Equity

INVESTING IN MULTIFAMILY: WHAT DOES THE DATA SAY?

Investment Performance and Returns

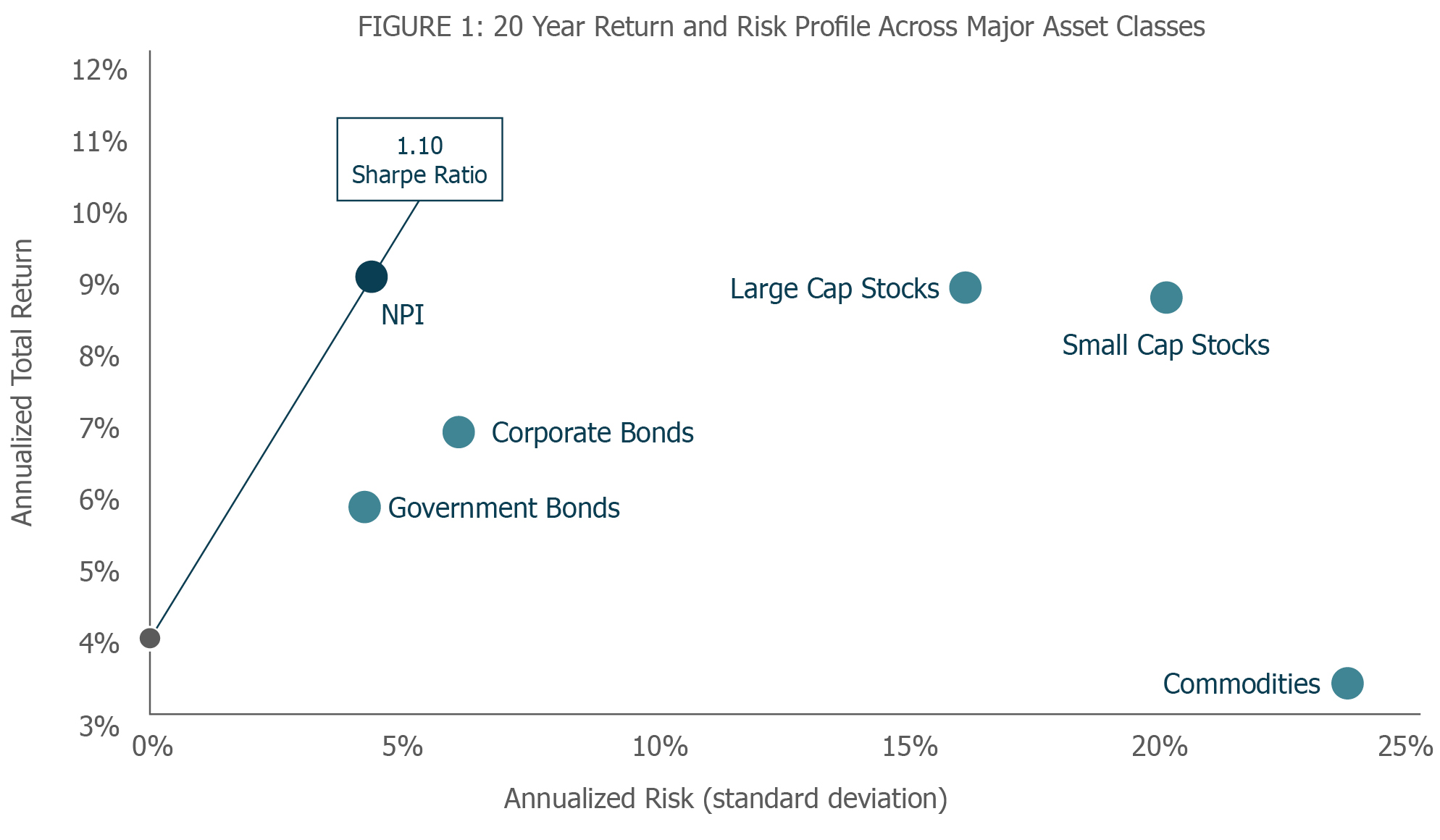

Multifamily has the highest risk-adjusted returns amongst the asset classes

Over the 25-year period from 1995 through 2020, multifamily real estate provided the highest average annual total returns (9.75%) of any commercial real estate sector with the second lowest level of volatility (7.75%), according to research cited in a 2018 report by CBRE, the world’s largest commercial real estate investment firm.

Average Annual Return and Standard Deviation by Property Type

| Sector | Average Total Return | Standard Deviation |

| Mulitfamily | 9.75% | 7.75% |

| Hotel | 9.61% | 8.36% |

| Industrial | 9.57% | 11.03% |

| Retail | 9.44% | 7.38% |

| Office | 8.38% | 9.64% |

CBRE Research NCREIF, Q3 2017. Based on trailing four-quarter total returns from Q3 1992 through Q3 2017.

Sharpe Ratio

Comparing the all-inclusive investment real estate categories against the alternatives, including stocks, bonds, and commodities—multifamily investments have the highest overall risk adjusted returns. The Sharpe Ratio measures the performance of an investment compared to a risk-free asset, after adjusting for its risk. The higher the Sharpe Ratio, the better the return per unit of risk. Source: Thomson Reuters Datastream

Supply and Demand Metrics

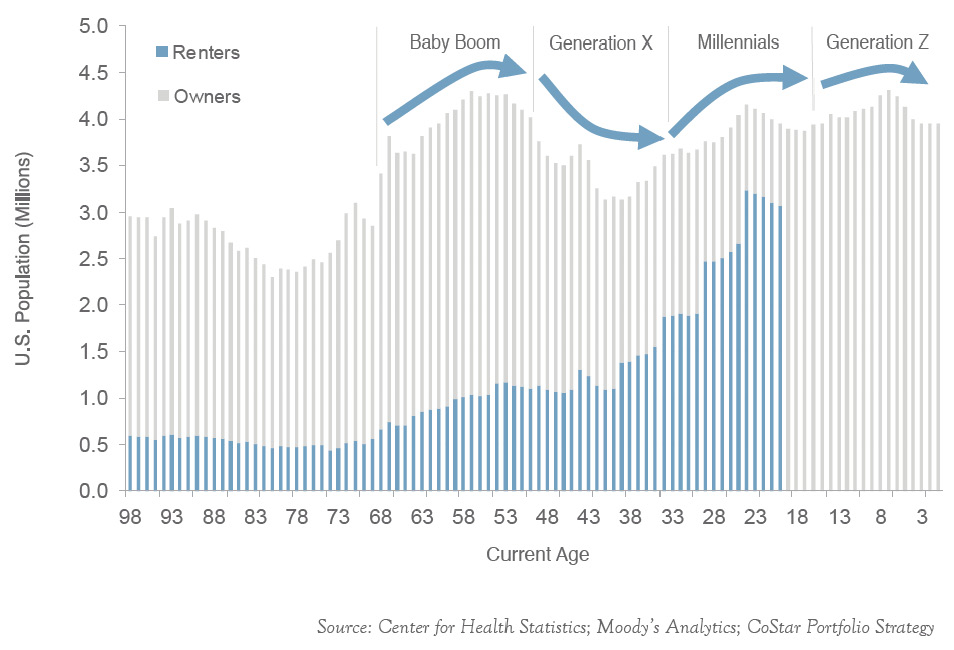

A major reason that multifamily property has a high investment risk and return profile is that it provides the basic need of shelter to a significant and growing demographic.

Low Risk and Low Volatility

The multi sector has consistently demonstrated that it is more resilient in economic downturns than any other asset class.

People need housing. So in difficult cycles, multifamily is affected only moderately and has the quickest road to recovery—more so than any other asset class. The sector is also an effective inflation hedge due to short-term leases and has unique abilities to generate excess returns through effective property management and the use of rehabilitation capital.

Abundant and Favorable Financing Sources

The high-return characteristics of the sector comes in part because of exceptional financing.

Low-risk and high-return characteristics of the sector have much to do with favorable financing. This includes the most favorable mortgage rates and terms, debt-service coverage ratios, and the most supportable and accurate valuations within the investment real estate universe. It is the only sector with U.S government backed lending programs through Fannie Mae and Freddie Mac.

Combine the unprecedented current and future demand with a constrained supply of multifamily housing, and the investment proposition becomes even more appealing.

We like the Real Estate Investment Trusts—(REITs). But investor returns in our sponsored, direct, multifamily opportunities exceed returns of the Public REITs.

While the REITs do provide investors with public market liquidity, investors typically sacrifice yield.

REITs grow at a slower pace. They can only reinvest a maximum of 10% of their annual profits back into their core business lines each year.

Our Value and Core strategies are less volatile and historically pay significantly higher comparative risk adjusted returns.

Private Equity’s ability to achieve higher returns compared to investing in the Public Markets is attributed to a several key factors:

-

Our Portfolio and Operating Managers have high powered incentives to drive values for our investors with lower deal expenses and fees.

-

The use of intelligent debt and leverage. This provides financing and tax advantages which are highly accretive to investment returns.

-

Unlike the REITs, our private equity model uniquely provides tax advantages through depreciation, tax-free refinances, 1031 exchanges, and legacy wealth transfers.

-

Our integrated management team keeps a constant and determined focus on cash flow and margin improvement, having a direct impact on investor values.